Q4 Letter - 2023

Q4’2023 Recap: A November and December to Remember; Fed Flip -> Markets Rip

The S&P 500 rallied sharply into the end of the year, closing with an 11.7% gain in Q4’2023 despite a weak start with a 2.1% decline in October. In our previous letter, we noted how strong Q4 has been in the previous four years. Coincidentally, this year turned out to be the strongest Q4 of them all. Since 2019, the S&P 500 has now returned 9.9% on average in Q4. As October kicked off, sentiment was low after Q3 2023 was the first quarterly decline for the S&P 500 for the year, down ~3.5%. Long-duration bonds were not safe either, within the Treasury market, the iShares 20+ Year Treasury Bond ETF (TLT) returned -7.9% in September and was down over 7% in October as well. Moreover, Treasurys were on track for their third consecutive year of losses, a historical anomaly that has never occurred in the entire 247-year history of the United States. However, on November 1st, bond yields crashed thanks to the “Fed flip” causing equities and bonds to rip. The “Fed flip” declaring their war against inflation nearly complete may prove premature, but there’s no question it has fallen much quicker than many expected, reaching 3.4% in December 2023. Furthermore, and top of mind for US consumers, gasoline prices have fallen from an average of just above $4.00/gallon in September to ~$3.20 in January.

2023 Was a Pretty Awesome Year for Financial Markets – Despite Wall Street Forecasting Declines

Looking back to the beginning of 2023, Wall Street Analysts had never been so pessimistic, it was the first time in decades that they expected the S&P 500 to end the year lower. How could they be so wrong?

Pessimism was widespread at the beginning of 2023. Many analysts were calling for a painful recession within the year, doubting the Fed’s ability to control inflation and the consumer’s ability to withstand additional rate hikes. There has been an abundance of contradictory data coming from leading economic indicators which amplified volatility, but nothing has proven to be more important than the resiliency in the US labor market. The bottom line has been that as long as the labor market remains robust, consumer spending, which accounts for ~70% of our economy, is likely to remain healthy. Therefore, a bet on a “soft landing” (no recession) is a bet on the US consumer, which is essentially a bet on the labor market remaining resilient.

We believe that going forward, specifically over the next 12 months, inflation data will be sharing the main stage with domestic jobs data in terms of impact on the financial markets. Even if inflation remains sticky and stubborn around ~3% or even inflects up again slightly, that’s likely not high enough for the Fed to disregard the other half of their dual mandate: The unemployment rate. Strengthening our conviction in this opinion is the fact that we’re in an election year. It’s not a very bold opinion that the current administration is highly incentivized to keep the unemployment rate below 4.0% for the rest of the year, at a minimum. It’s worth noting that we closed out the year with the 22nd consecutive month of an unemployment rate below 4%, the longest such streak since the late 1960s.

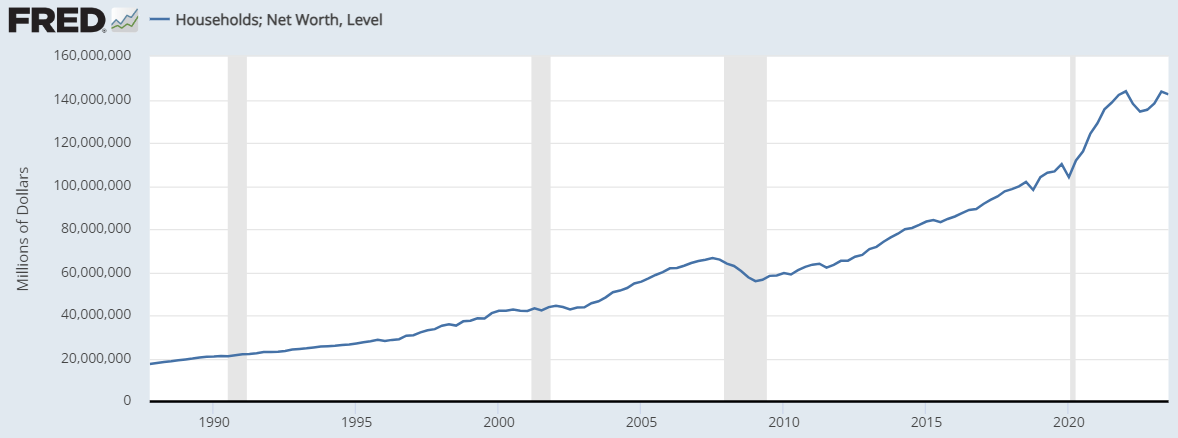

For those who consume content from US mainstream media, you have seen the frequent coverage of how much debt US consumers have, or the mentions of factors that could derail the US consumer: resumption of student loan payments, high credit card balances, etc. However, they don’t mention as often just how much disposable income and household net worth has been rising too. Personal disposable income was up just over 6% in 2023, and household debt service payments as a percent of disposable income are still slightly lower than 2019 levels of 10%, and well below the Q4 2007 level of 13.3% (see chart below). US household net worth remains hovering near all-time highs, so US consumers have been well-equipped to handle rising rates and rising costs.

Q4’23 Earnings Preview – Optimism is Justified

Q4 2023 earnings kicked off last week. The S&P 500 is estimated to post year-over-year earnings growth of 1.6%. However, over the past four quarters (Q4 2022 through Q3 2023), actual earnings reported by S&P 500 companies have exceeded estimated earnings by 5.7% on average, which suggests this will be the 2nd quarter in a row of growth after 3 quarters of earnings declining on a year-over-year basis, confirming that earnings growth has inflected firmly into the green.

Trumping the importance of earnings reported in Q4, will be the outlook for the next quarter, Q1 2024, and analysts are projecting earnings growth to continue. Earnings growth is forecasted at 5.7% for Q1 2024 and 10.2% for Q2 2024. For CY 2024, analysts are calling for year-over-year earnings growth of 11.8%, suggesting that the earnings recession has indeed troughed, and we have now entered a new cycle of earnings growth (see chart below) which began Q3’23 with earnings growth of 4.9%.

However, there are a multitude of risks keeping us cautious about the near-term, primarily how much optimism has been pulled forward off the back of expected rate cuts, and thus the market could begin to get impatient with the Fed’s guidance of multiple rate cuts this year. Skeptics will say that valuation will be a headwind, although the forward 12-month P/E ratio for the S&P 500 is ~19x, roughly in-line with the 5-year average, but slightly above the 10-year average (17.6x). Even beginner-level investors know that investing in stocks isn’t as easy as just buying the ones with low P/E ratios. “Expensive” stocks can remain expensive and become more expensive, and “cheap” stocks can remain cheap, and become even cheaper.

Note that despite us being in a potentially choppy period as we digest the gains from Q4, we remain optimistic on the outlook for 2024.

2024 Outlook

Financial markets have adjusted rapidly to reflect the shift in the Wall Street consensus about the number of upcoming rate cuts increasing. Concerningly, this has happened despite the evidence that the economy is no longer slowing gradually, but gaining steam. Despite this economic strengthening, the implied odds of a March rate cut are up to 67 percent, according to the CME Group's FedWatch tool. Two months ago, they stood at 21 percent.

Despite a little too much optimism being pulled forward in the short-term, ultimately, we continue to believe that this is a market to remain invested in as many high-quality companies are emerging even more efficient, through both cost rationalization and increased productivity enabled by AI working their way through corporate procurement centers over the next few years. Technological advancements continue to compound and these take time to become adopted and reflected in the financial results of companies via productivity gains. Additionally, the markets are also in a unique position where downside risk is limited as the Fed is in a position of strength given, they can lower interest rates from their current restrictive levels of 5.25% - 5.5%. This maneuver would ease financial conditions, preventing the economy from entering a painful recession that many are fearful of. It’s human nature to exhibit recency bias and incorrectly project how painful the last great recession was, and assume that other future recessions will be equally as damaging. When as discussed, US consumers are still in great shape, with a high margin of safety in their financial position, also evidenced by record cash levels and ~$6 trillion in money market accounts, which can be viewed as a good indication that there is hesitation in investor appetite for risk.

Note that these money market accounts have attractive yields that are higher than the rate of their mortgages. ~75% of US homeowners have a mortgage below 5.0%, and with money markets yielding above 5.0%, counterintuitively, higher rates for longer are beneficial to those with fixed low-rate mortgages (however, note that money market yields will begin to decline once the Fed begins to normalize interest rates by bringing them down toward ~3.5%).

The prevailing low mortgage rates enjoyed by a majority of US homeowners are actively contributing to the enduring scarcity of housing inventory. This scarcity, in turn, is supportive of housing prices, a fundamental pillar of US consumer household wealth. Consequently, the real estate market is poised to sustain its resilience, as homeowners find reassurance in the significant appreciation of their homes, marking an extraordinary ~40% increase over the past four years—the largest four-year gain on record.

There’s no question that this is a data point that is sitting at an extreme, which is always a reason to maintain a watchful eye. Most of the time, extremes don’t tend to last forever, but that doesn’t mean that we must experience a huge crash any time soon – late-cycle dynamics can extend and last for years.

We are grateful for the trust that you have placed in us to monitor these conditions affecting the financial markets, and we look forward to continuing to serve as your partner in achieving your financial goals. If you have any questions or concerns, please do not hesitate to contact us.

Information presented reflects the personal opinions, viewpoints and analyses of the employees of Mirador Capital Partners, LP, an SEC-registered Investment Adviser. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mirador Capital Partners, LP manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Visit us at miradorcp.com for more information.