Biotech/Medtech On the Rise in the Tri-Valley

Last year over $200 million in venture capital was raised for biotechnology and medical technology in the Tri-Valley.

Why are companies in this space continuing to choose the Tri-Valley?

Biotechnology and medical technology companies are capitalizing on the rare aggregation of resources in this area, which aid them in their pursuit to develop groundbreaking and lifesaving products here.

Biotechnology refers to the application of biology in technology products. Examples include genetically modified plants, DNA profiling in a forensics field, or Unchained Labs' range of biologics products.

Medical technology, on the other hand, refers to healthcare products developed to diagnose, treat or monitor medical conditions. The devices made by Pleasanton-based Natus Medical (NASD: BABY), engineered to assist with everything from hearing loss to jaundice, are examples of medtech.

Both industries have remarkable track records in the Tri-Valley and are flourishing here unlike anywhere else in the nation. Whether established or nascent, the companies that comprise this medical ecosystem setup shop in the Tri-Valley in the interest of benefitting from access to capital, proximity to specific biologic technology, and reasonably priced workspace.

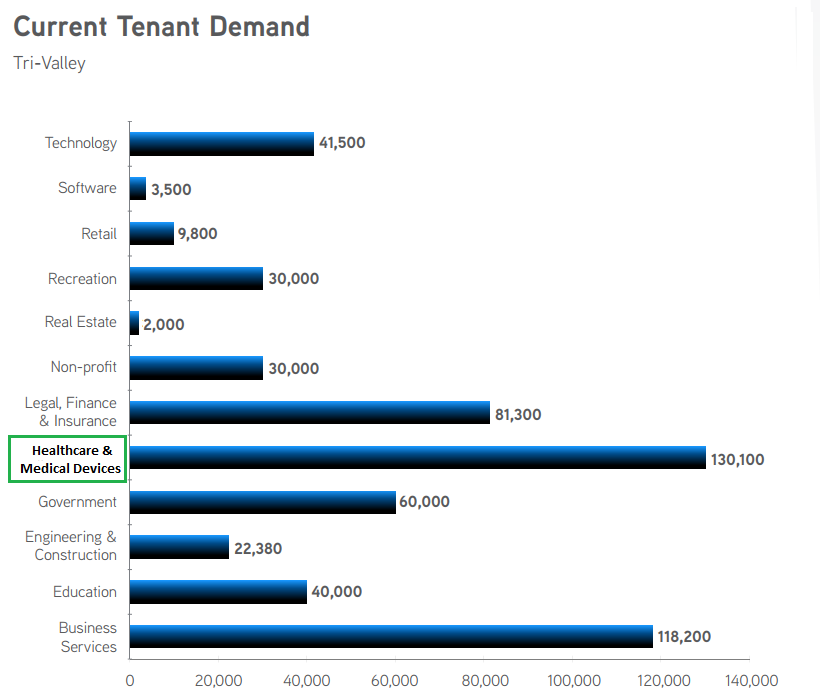

Demand for Office Space

As illustrated by the graph below, "The highest demand for office space in the Tri-Valley has been for healthcare and medical device companies, accounting for nearly 25% of all commercial space needs."

Biotech and medtech are not new entrants to the Tri-Valley market. Corporate giants Roche Molecular Diagnostics, who occupy nearly 400,000 SF in Hacienda Business Park, and Thermo Fisher Scientific, who have a large campus in Pleasanton, have maintained their presence here for years.

It’s easy to understand why businesses, including those outside the bio/med technology fields, would be attracted to office space in the Tri-Valley.

Relative to nearby San Francisco and Silicon Valley, space here is available at a significant discount. Office rents in the Tri-Valley have an average asking rent of $2.68/SF while Silicon Valley office rents average $4.23/SF and San Francisco a pricey $71.93/SF.

Newmark Knight Frank recently praised Hacienda Business Park as it "provides its individual and corporate tenants with unmatched quality of life including access to world-class restaurants, theaters, museums & art galleries, the best learning institutions in the country, corporate resources, proximity to industry leaders, and a variety of office and residential accommodations."

Proximity to Knowledge Hubs

During the 1950s, scientists began to flow into Livermore to staff the newly formed National Laboratories. Effectively mobilizing a highly educated workforce overnight. The population saw significant increases during this period and the levels of human capital skyrocketed.

Lawrence Livermore National Laboratory and neighboring Sandia National Laboratories have a rich history of developing biologic and medical technology. These local titans of innovation have been delivering state-of-the-art tech since the inception of LNLL in 1952. With 6,500 and 910 employees respectively, the labs are among the top employers in Livermore.

The public sector frequently benefits from the laboratories’ scientific developments, evidenced by their perennial appearance on the prestigious R&D 100 list. See the list of 2016 winners on which you will find LNLL twice and Sandia five times.

Of particular interest to biotech companies in the area is LNLL's High-Performance Computing (HPC) technology which is leveraged to solve a range of problems.

Former lab employees have, on a few occasions that we are aware of, taken their skill set to the private market and been able to launch successful companies while retaining the culture of our unique ecosystem by opening shop in the Tri-Valley.

One such example is Sandstone Diagnostics, founded by former Sandia employee Greg Sommer. Sandstone was recently a recipient of the #GameChanger award by Innovation Tri-Valley Leadership Group for its innovative home fertility diagnostic testing product, Trak.

For startups, access to the technology generated by the continuous innovation at LNLL and Sandia is a goldmine.

The lab even has a dedicated position, currently filled by Richard Rankin, known as the technology transfer expert. The role of this position is to promote products developed at LNLL to businesses outside the lab's walls.

Capital Raised

Last year was the highest on record for venture funding in the area. Over $350 million was raised in the Tri-Valley and 55% of it was in the medical technology space.

Below is a table we created for our research piece The Mirador View: Perspectives on the Tri-Valley charting the VC investment for bio and med tech companies in the Tri-Valley from Jan. 2016 through Jan. 2017.

The largest funding amounts in 2016 were 10X Genomics. who are working to improve the application of genome sequencing, at $55 million, and Unchained Labs, a life sciences tools company, at $25 million.

Established Tri-Valley companies continue to thrive as well. This February, Pleasanton company Zeltiq agreed to be acquired by pharmaceutical giant Allergan for $2.5 billion.

Conclusion

Biotech and medtech companies have established themselves as dominant players in the Tri-Valley. The assets available to these companies are unique and plentiful, which, for those able to innovate and take advantage, enable extraordinary success. We are keeping a close eye on these sectors and plan to invest where we see opportunity.

Information presented reflects the personal opinions, viewpoints and analyses of the employees of Mirador Capital Partners, LP, an SEC-registered Investment Adviser. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mirador Capital Partners, LP manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Visit us at miradorcp.com for more information.