Q1 Letter - 2025

Q1 2025: The Bull Takes a Breather

Macroeconomic Recap – Resilient Economy Meets Policy Crosswinds

After two years of robust gains, the first quarter of 2025 reminded investors that markets don’t move in straight lines. Growth remained underpinned by a still-strong U.S. economy, but new headwinds emerged, notably a revival of tariff pressures. The Federal Reserve, for its part, paused its rate-cutting campaign and struck a cautious tone. In its March meeting, the Fed held the policy rate steady at 4.25%–4.50%, following a cumulative 1% of cuts in late 2024. On the inflation level, the deceleration in price increases showed signs of leveling off. After a sharp jump in January, consumer inflation moderated in February – the headline CPI rose just +0.2% on the month, bringing the annual rate down to 2.8%. Core CPI (ex-food and energy) is running around 3.1% year-over-year. This suggests that while inflation is far below last year’s peaks, it’s not yet cleanly back to the 2% target. The Fed will be looking at expectations carefully, but for now it views the tariff-induced price increases as a one-off effect rather than a persistent trend.

Meanwhile, the labor market remains a source of strength, albeit with some tentative signs of cooling. U.S. payrolls expanded by +143,000 in January (versus a booming +307k in December, and below forecasts of ~169k), and by roughly +150k in February. This marks a step down from the ~250k+ monthly job gains averaged last year but still indicates healthy labor demand. The unemployment rate went to 4.2% as of March, essentially back to pre-pandemic lows, and initial jobless claims have remained low, suggesting layoffs are not widespread. A gradual cooling in job growth, if it continues, may actually prolong the expansion by reducing the risk of an overheating economy. As of now, there is little evidence of the labor market “cracking”: the slowdown looks more like a return toward normal after the post-Covid hiring frenzy, rather than a sudden stop. So long as Americans remain employed and earning, consumer spending should continue to drive corporate revenues. Indeed, recent data on consumer activity (retail sales rebounded +0.2% in February after a January dip) show the U.S. consumer is still in the game.

Market Performance – A Volatile Quarter for Stocks and Bonds

After a remarkable run in 2023 and 2024 (the S&P 500 gained just over 20% in each of those years), the equity market hit an air pocket in Q1 2025. Investors faced a wall of worries, from the Fed’s tighter stance to fresh trade tensions, and many took profits in the last cycle’s big winners. The result was the choppiest quarter in recent memory and the first meaningful pullback in over a year. The S&P 500 index ended Q1 with a modest loss (its first quarterly decline since late 2022.) The Nasdaq Composite, loaded with last year’s high-flying tech names, fared worse, sliding about –14% from its late 2024 highs. To put this pullback in perspective, it was the sharpest drop of this magnitude since early 2020. However, it’s also important to note that major indexes are still above their levels from a year ago, essentially, the market gave back a portion of the outsized gains accumulated in the 2022–2024 bull run. In other words, we’ve seen a healthy rotation and consolidation, rather than a collapse. Indeed, many overseas markets actually rose in Q1 (developed international stocks gained ~6%, emerging markets +3%), and even within U.S. equities, the damage was concentrated in a few sectors.

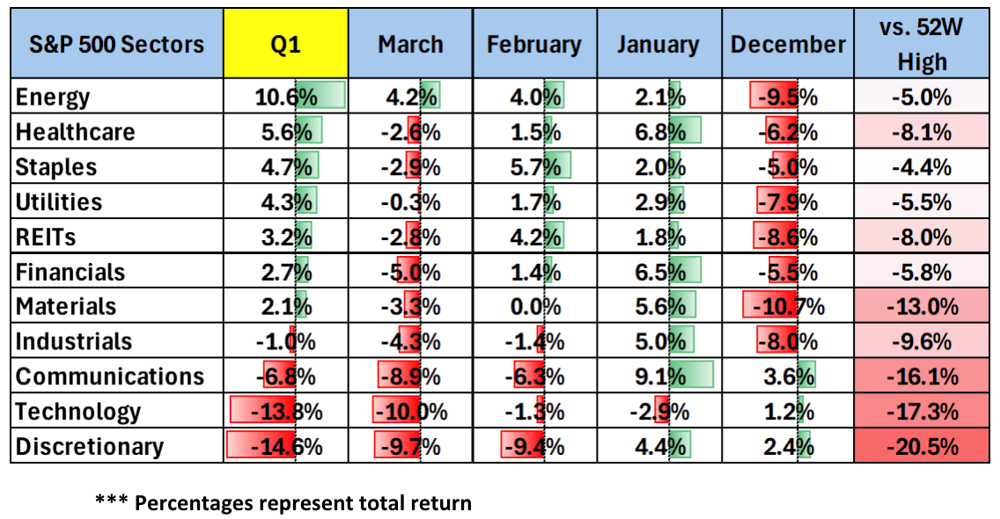

The leadership board for Q1 flipped upside-down compared to last year. The sectors that had been the biggest winners of 2023–24 suddenly turned into laggards, and vice versa. Technology stocks, which powered the previous rally, were hit especially hard, the tech sector fell roughly –14% in Q1 as investors reassessed lofty valuations and braced for potential supply-chain disruptions from new trade policies. The Consumer Discretionary sector (which includes retail, autos, and travel) was another casualty, down about –15% for the quarter. This group was dragged down in part by the auto industry and by profit-taking in mega-cap internet and e-commerce names that had soared last year. Communication Services (home to internet and media giants) also dipped into the red. In contrast, traditionally defensive or value-oriented sectors actually notched gains. Health care, consumer staples, utilities, and real estate – steady sectors with dependable cash flows – each rose between 3% and 6%. Even the Financials sector managed a small gain (~+3%). The stark divergence in sector fortunes suggests that investors were rotating, not panicking, shifting money from expensive growth stocks into more reasonably valued, economically insensitive areas.

Beneath the index level, the breadth of the market actually showed some improvement. Unlike last year, when a handful of tech giants (the “Magnificent Seven”) accounted for an outsized share of gains, this quarter saw a broader mix of contributors. Smaller-cap stocks initially showed resilience, the Russell 2000 small-cap index was up in early 2025, though they too succumbed to the tariff-related volatility by March. Market volatility spiked on headlines prompted by policy uncertainty and a natural bout of profit-taking. From our perspective, this reset is not only normal but healthy. It has relieved some of the speculative froth, brought down ultra-high valuations (the S&P 500’s forward P/E slid to about 20.7x by end of March), and created a more balanced market going forward.

Q1 2025 Earnings Preview – Steady Growth, but Guidance is Key

As we turn the page to Q2, corporate America is gearing up to report first-quarter earnings. Expectations are cautiously optimistic. S&P 500 earnings are forecast to have grown around 7% year-over-year in Q1, with revenues up ~4%. The margin outlook is a particular focus this quarter, because even as revenue growth has been decent, companies are now dealing with some new cost pressures including tariff-related import costs. S&P 500 net profit margins are expected to be in the mid-11% range. Any commentary on pricing power (i.e. ability to pass on higher costs to customers) will be key. For example, industrial and consumer product firms may face higher input prices due to tariffs on steel, aluminum, and components – will they absorb those costs, or raise prices? Thus far, many companies have been able to preserve margins through efficiency gains and selective price increases, taking advantage of the still-healthy consumer demand.

Overall, if Q1 earnings indeed rise mid-to-high single digits, it would underscore that the fundamentals remain intact despite all the noise. However, we expect investors to be less concerned with the backward-looking results and more keenly tuned into managements’ outlook for the rest of 2025. Any discussion of tariffs, supply chains, or hiring plans on conference calls will be highly illuminating.

Looking Ahead – Trade Winds, Tariff Tactics, and the Path Forward

The trade winds shifted dramatically in early April, as the U.S. administration moved from rhetoric to action on tariffs. On April 2, President Trump unveiled sweeping new trade measures: a universal 10% levy on all imports into the U.S., with even steeper rates for certain countries (including a hefty 34% tariff on Chinese goods). This blanket approach represents one of the most aggressive shifts in U.S. tariff policy in recent memory. It effectively broadened the trade conflict to cover almost every major trading partner, catching many businesses off guard and forcing a rapid reassessment of supply chains and costs. The immediate effect was to jolt global trade expectations, businesses across sectors are now bracing for increased costs, longer lead times, and new operational challenges.

International responses were swift and pointed. China quickly retaliated with its own tariffs of up to 84% on U.S. exports, a stark escalation that underscores the intensity of this standoff. The European Union likewise approved 25% duties on select American products (ranging from agriculture to industrial goods) in response. Even U.S. neighbors have bristled: Canadian and Mexican leaders condemned the tariffs as unjustified and violations of the USMCA trade agreement. Both countries signaled they are weighing countermeasures, though Mexico’s response so far has been more cautious.

Federal Reserve officials have acknowledged the inflationary impact: internally, the Fed has nudged up its inflation outlook to account for the tariffs. Fed Chair Powell, however, maintains that the impact should be “transitory,” a one-off price level adjustment rather than a lasting inflation surge. In practice, the central bank faces a more complicated outlook, policymakers must now weigh higher inflation against potential growth headwinds from a trade-induced slowdown.

Technology hardware and electronics firms, heavily reliant on Chinese and Vietnamese components, face steep cost increases that may compel price hikes and could even delay product launches as supply chains adjust. Automakers and industrial manufacturers now see tariffs on imported parts complicating production schedules and forcing a rethink of sourcing strategies. Many manufacturers with globally distributed operations are racing to re-route supply chains. Retailers and consumer goods companies are also under pressure. Those with significant sourcing from Southeast Asia (for example, apparel or electronics retailers dependent on Vietnam or Cambodia) are bracing for narrower profit margins as input costs rise. In many cases, these firms will face a tough choice: absorb the higher costs and hurt profitability, or pass them to consumers and risk denting demand. Even the energy sector isn’t immune. Across the board, “tariffs” has become the business buzzword of the quarter – corporate earnings calls and forecasts are now intensely focused on how to mitigate these rising costs and whether consumer demand will hold up in the face of possible price increases.

Financial markets have wasted no time pricing in the new trade reality. In equity markets, trade-sensitive sectors (industrials, technology, and consumer discretionary) have lagged, and the broader indexes have turned volatile. In fact, the S&P 500 just endured a sharp selloff, at one point coming close to bear market territory, as investors grappled with the prospect of a protracted U.S.-China trade war. European and Asian stock markets likewise fell in sympathy, reflecting fears that a spiral of tariffs could undercut global growth. Interestingly, bond markets also flashed warning signs: instead of rallying on the stock downturn, U.S. Treasuries saw yields rise alongside the equity slide, an unusual pairing that signals inflation worries overtaking the usual flight-to-safety dynamics. In other words, investors dumped bonds as well, concerned that tariff-driven price increases might erode fixed income returns. The U.S. dollar softened in recent days against other major currencies, a move perhaps driven by expectations that American growth could take a hit (and by some foreign investors reducing U.S. asset exposure). This mix of weaker stocks, higher yields, and a softer dollar is a telling barometer of market anxiety – it points to concerns that trade frictions will both heat up inflation and cool down growth.

The administration has subsequently introduced a 90-day pause on most of the new levies, reducing the base import tariff to 10% while simultaneously increasing duties on Chinese goods to 125%. Markets responded sharply to the pause, with the S&P 500 surging nearly 10% reflecting relief that the tariff rollout may be less disruptive than initially feared. However, China’s retaliatory tariffs of up to 84% on U.S. goods kept tensions elevated, while the EU signaled openness to negotiate under the temporary reprieve.

Thank you for your continued trust and partnership. 2025 has thrown us a curveball or two, but together we will navigate these developments just as we have navigated past challenges. We remain as committed as ever to guiding you through the uncertainty and toward your financial goals. Here’s to the journey ahead – with eyes open to risks, but also to the opportunities that inevitably accompany them.

Information presented reflects the personal opinions, viewpoints and analyses of the employees of Mirador Capital Partners, LP, an SEC-registered Investment Adviser. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mirador Capital Partners, LP manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Visit us at miradorcp.com for more information.