Q2 Letter - 2025

Q2’ 2025: The Market Rebound Amid the Shifting Current

Macroeconomic Recap – The Rebound

After a volatile start, the second quarter of 2025 delivered renewed strength in markets, and as rate cuts loom, the U.S. economy seems to be heating up. Growth remained intact, yet pressure points began to emerge. Tariff shocks early in the quarter rattled the overall sentiment, though markets recovered sharply following a White House decision to pause reimplementation. Meanwhile, the Federal Reserve maintained its policy stance, and inflation trends offered room for easing later in the year.

The Fed held the federal funds rate steady at 4.25% - 4.50%, unchanged from Q1. By quarter-end, markets were pricing in 50–75 basis points of cuts before year-end, with the first expected in September. On inflation, Core PCE rose 0.2% in May, with the 3-month annualized rate running above 2.5%—still above target, but moving in the right direction. While inflationary pressure from tariffs had not yet materialized, firms continued drawing down pre-tariff inventory, suggesting a potential price increase could show up in the second half.

The labor market is holding, but it's cooling off. Unemployment remained steady at 4.1% in June 2025, but lower participation, shrinking hours, and a slowdown in private hiring suggest deceleration. Manufacturing and construction are stalling, and longer unemployment durations and workforce exits are creeping up. So, while consumers still lean on jobs to spend, cracks are appearing beneath the headline stability.

On April 2, 2025, the White House announced sweeping "Liberation Day" tariffs—10% baseline plus country-specific duties—triggering a ~12% drop in the S&P 500 across the next four sessions. But when the administration paused the tariffs for 90 days on April 9, the S&P rocketed 9.5% in a single day, its biggest daily gain since October 2008 and one of the top eight ever. The volatility reflected market relief and hope that the tariffs won’t stick, but the risk remains as the deadline approaches and negotiations play out.

In June, the House passed a new tax-and-spending package extending the 2017 tax cuts and boosting defense outlays. Moody’s downgraded the U.S. sovereign credit rating to Aa1, citing concerns about long-term debt sustainability. Following the downgrade and massive new issuance, 10‑year Treasury yields rose to ~4.3–4.4%, while the 30‑year yield edged up to ~4.8–5.0%. Meanwhile, the Dollar Index fell to a three-year low, supporting U.S. investors’ foreign equity returns.

Market Performance – Record-Breaking Amid Underlying Uncertainty

The Nasdaq Composite led all major benchmarks with a bolstering +17.8% gain, powered by a narrow group of AI-leveraged mega cap stocks, including Nvidia, Apple, and Uber, that continue to capture a disproportionate share of investor flows. While this concentration raises long-term sustainability concerns, the outperformance reflects confidence in the long-term monetization of AI technologies across sectors. Importantly, the rally broadened beyond just tech giants. The Russell 2000 rose +3.5%, turning positive year-to-date and signaling improving market breadth. The Dow Jones Industrial Average climbed +5.0%, supported by a strong showing in industrials and consumer cyclicals, underscoring a modest return of value-oriented positioning.

Sector leadership in Q2 reflected a subtle shift in sentiment. While technology and communication services remained in the driver’s seat, there was increased bullishness toward traditionally defensive groups such as utilities, healthcare, and consumer staples.

Energy stocks were mixed, with underlying volatility in oil prices, influenced by renewed Middle East instability (notably between Israel and Iran) and continued disruptions from the Russia–Ukraine conflict. Materials and industrials were positively correlated with infrastructure trends and tariff-sensitive supply chains, though they face potential headwinds in Q3 depending on U.S. trade policy outcomes.

Growth continues to dominate, but value sectors showed pockets of resurgence, particularly as traders began pricing in more modest returns for AI names after a multi-quarter surge. Amid global uncertainty and growing concern over elevated valuations, alternative investments and commodities gained momentum in Q2. Gold soared to new record highs, as investors sought refuge from equity volatility, political unpredictability, and a weakening U.S. dollar. Silver followed closely behind, supported both by its safe-haven properties and growing industrial demand, particularly from green energy and semiconductor supply chains.

Real Estate saw mixed performance. Multifamily housing in Sun Belt metros continued to show steady rent growth, supported by population inflows and supply constraints. Industrial and logistics real estate remained in demand thanks to e-commerce tailwinds and onshoring trends. However, the office sector remains deeply distressed, with some urban assets trading at 30–50% discounts to peak valuations, a reflection of persistent hybrid work structures and muted leasing demand.

Q2 2025 Earnings Preview – Strength at the Surface, Scrutiny Beneath

As we enter the second half of the year, corporate America is preparing to report Q2 earnings amid a backdrop of strong equity performance but growing macro crosscurrents. Expectations remain broadly positive: S&P 500 earnings are projected to rise around 5% year-over-year, with revenue growth tracking near 4.2%. Tech and communication services are expected to lead gains, supported by ongoing AI-driven demand and pricing momentum. However, investors are increasingly focused on cost control, forward guidance, and the evolving tariff landscape.

Margins will once again be a critical focus. While topline growth remains solid, companies are now navigating a more complex cost environment, including rising import expenses tied to the reimplementation of tariffs and shifts in global supply chains. S&P 500 net profit margins are forecast to hover around 12.5%, slightly higher from Q1 levels. This will test how effectively companies can protect profitability through automation, sourcing flexibility, or selective pricing actions.

Pricing power will be especially scrutinized. In sectors like industrials, autos, and consumer electronics, tariff exposure is front and center. Firms importing raw materials, components, or finished goods, particularly from Asia, may face immediate input inflation. Will they pass these costs onto customers, or will they accept margin compression to preserve market share?

Strong performance by AI-related stocks and steady consumer spending have kept investors optimistic and helped companies maintain solid profits. However, we remain early in the AI adoption curve and while enthusiasm is high, it will take time for most companies to fully integrate AI into their operations and realize meaningful efficiency gains, as they work through a steep learning curve and develop the necessary skills, processes, and infrastructure. As we head into this quarter, investors will be closely attuned to signs of stress in housing, manufacturing, and labor markets, as well as commentary around rate sensitivity, particularly for debt-heavy sectors like real estate and utilities.

If Q2 earnings ultimately post high-single-digit growth, it will reaffirm the strength of corporate fundamentals. But the real driver of equity performance may lie in management commentary. With valuations stretched and economic signals mixed, forward guidance for Q3 and Q4 will likely matter more than actual results.

Investors will be listening closely for outlooks on tariffs, capital expenditures, supply chain adjustments, and hiring plans. Given heightened political rhetoric and upcoming policy decisions, this earnings season could shape not only sentiment but positioning for the remainder of 2025.

Three Trends To Define 2025

Tariff Impact – More Federal Revenue

Tariffs were a defining force in Q2 2025, reshaping trade volumes and delivering a notable boost to U.S. government revenue. The U.S. collected $22.2 billion in duties in May, up 42% from April’s $15.6 billion, for a total of $37.8 billion over the two months. The duties collected in May alone accounted for 6% of total federal income, underscoring the scale of the policy’s financial footprint. These increases followed renewed tariffs on steel, aluminum, autos, and goods from China, Mexico, and Canada.

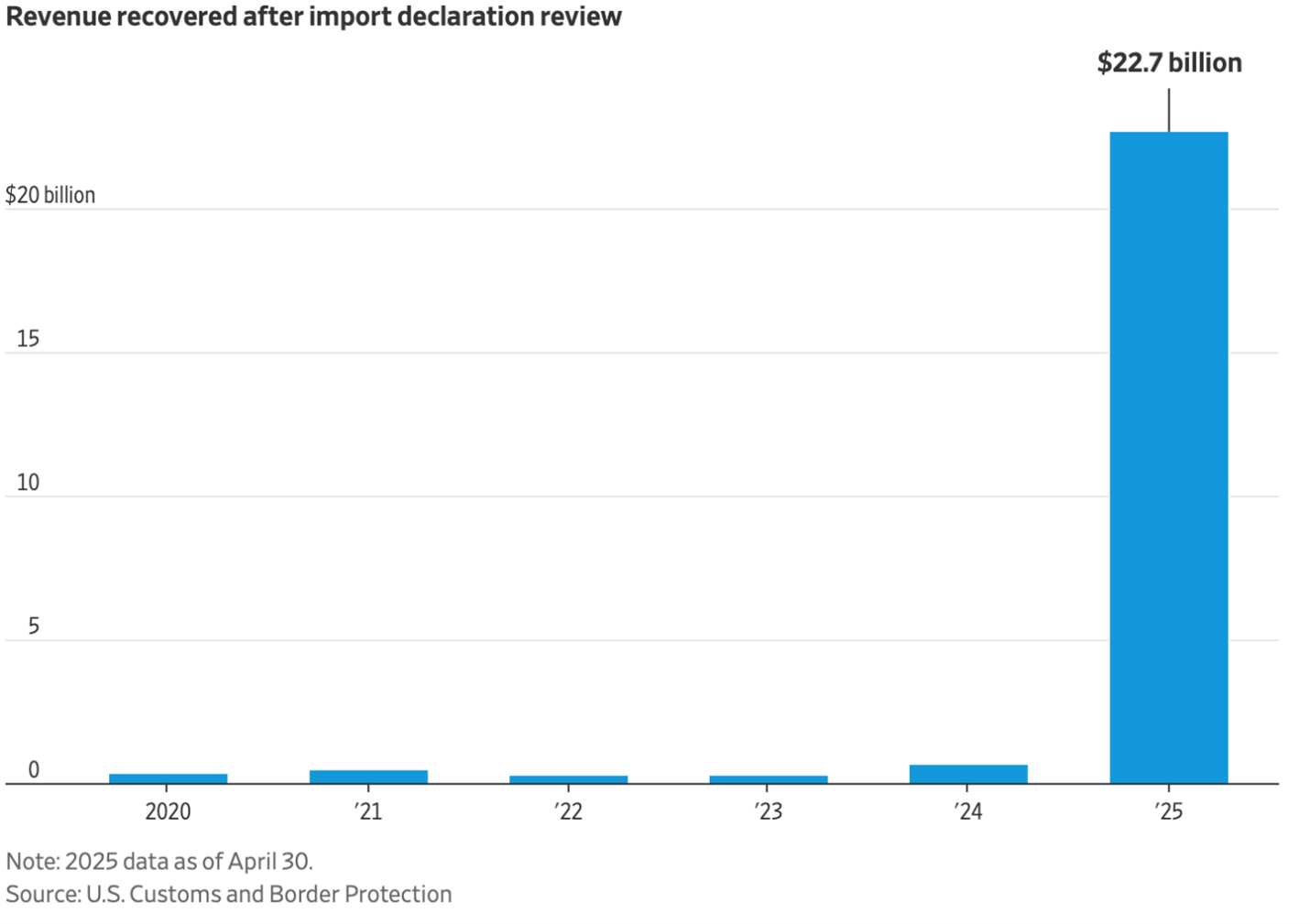

Increased customs enforcement played a role as well. Customs and Border Protection has significantly stepped-up enforcement efforts this year. The agency recovered nearly $23 billion in duties paid only after import compliance reviews — a dramatic surge compared to prior years. From 2020 through 2024, annual recovery totals never exceeded $0.7 billion, making the 2025 figure an outlier in both scale and pace. This sharp increase reflects the government’s more aggressive posture on tariff enforcement and revenue collection. While many firms began the quarter drawing down pre-tariff inventories, importers across sectors are now facing higher landed costs. With input prices rising and trade flows shifting, pressure may begin to build in Q3 earnings reports, especially for manufacturers and retailers reliant on cross-border supply chains.

Looking Ahead – Tariff Resets, Policy Shifts, and Market Implication

Tariff reimplementation remains a pivotal risk entering Q3. If the pause expires, reciprocal tariffs ranging from roughly 11% to 50% are expected to kick back in on a wide array of imports. Companies are already warning that, once pre‑tariff inventories run dry, tighter margins will follow. Larger firms with pricing power may be best positioned to absorb these costs, while smaller players could face more volatility in both margins and their forward guidance.

The Federal Reserve is also approaching a potential inflection point. With core inflation easing and employment data softening, markets are pricing in the first rate cut in September, followed by an additional 25–50 basis points by year-end. However, the U.S. sovereign downgrade by Moody’s has injected uncertainty into the Fed’s policy calculus, particularly as fiscal expansion continues. Any sign of upward inflation pressure-especially from tariffs-could delay or reduce the magnitude of easing. Equity markets have been buoyed by strong Q2 earnings and optimism around rate relief, but valuation levels remain elevated. The S&P 500 now trades at roughly 23.6x forward earnings, leaving limited room for upside surprises.

Since 2022, investor sentiment in tech and software shifted hard—from a growth-at-all-costs mentality to a focus on profitability and capital efficiency. In a tighter funding environment, free cash flow became king, and capital discipline started to outweigh topline expansion. It marked a clear pivot toward quality: investors prioritized businesses with real operating leverage and sustainable fundamentals.

But more recently, the pendulum appears to be swinging back. There's growing appetite again for high-growth companies, even those still burning cash, especially in markets where speed matters more than margins. It’s a reminder that investor preferences are cyclical—and this latest tilt back toward growth over profitability could signal another turn in the market cycle. As always, we remain focused on data, positioning, and long-term fundamentals as we navigate a market environment that continues to evolve. As we close out Q2, we’re reminded that volatility often precedes opportunity. Onward—with focus, patience, and conviction.

Information presented reflects the personal opinions, viewpoints and analyses of the employees of Mirador Capital Partners, LP, an SEC-registered Investment Adviser. The views reflected in the commentary are subject to change at any time without notice. Nothing herein constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Mirador Capital Partners, LP manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Visit us at miradorcp.com for more information.